World Energy Outlook 2024

Status:: 🟩

Links:: Energy Consumption & Carbon Emissions of Data Centers

Metadata

Authors:: IEA

Title:: World Energy Outlook 2024

Date:: 2024

URL:: https://www.iea.org/reports/world-energy-outlook-2024

DOI::

IEA (2024) ‘World Energy Outlook 2024’. Available at: https://www.iea.org/reports/world-energy-outlook-2024 (Accessed: 2 December 2024).

Notes & Annotations

Color-coded highlighting system used for annotations

📑 Annotations (imported on 2024-12-02#14:20:30)

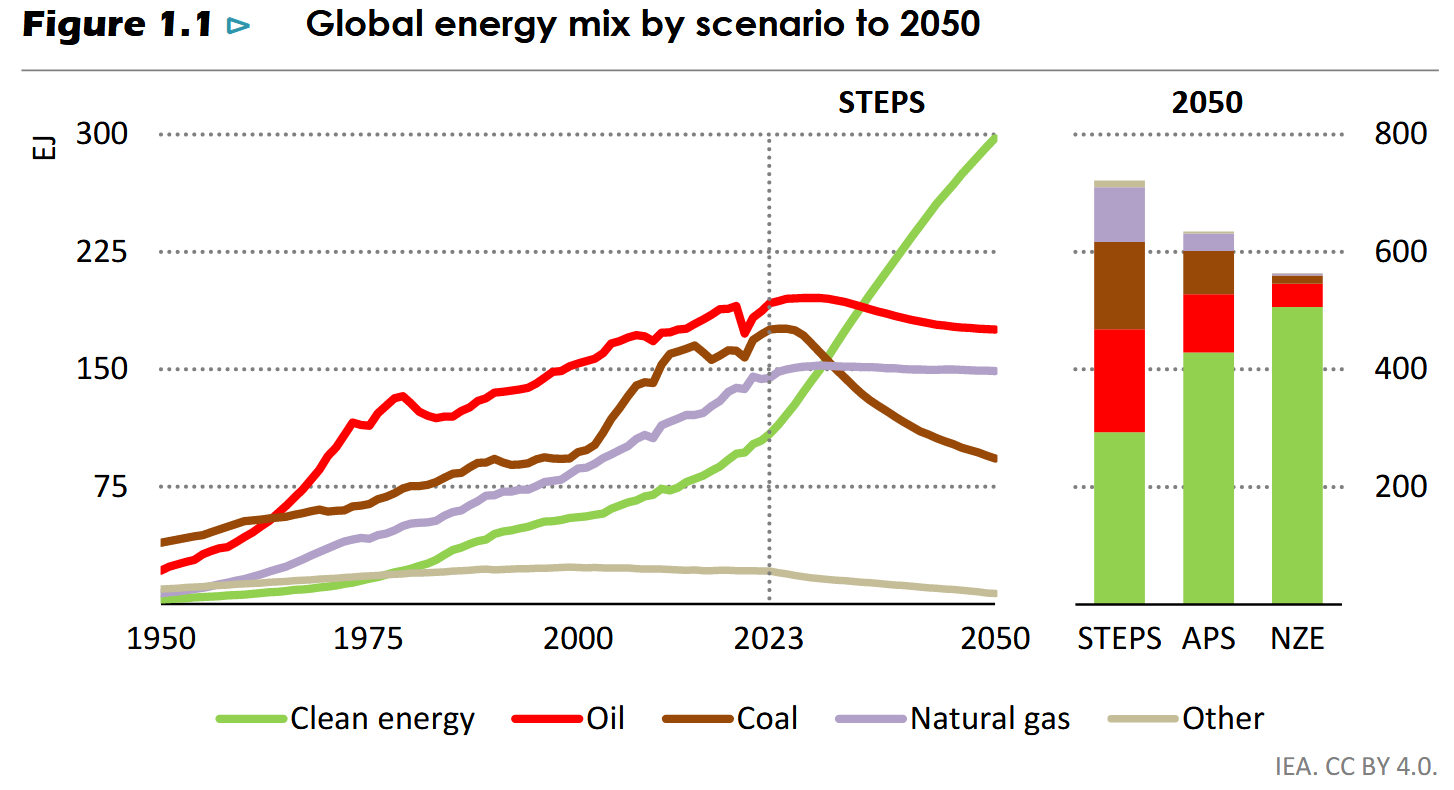

The Stated Policies Scenario (STEPS) provides a sense of the energy sector’s direction of travel today, based on the latest market data, technology costs and in-depth analysis of the prevailing

policy settings in countries around the world. The STEPS also provides the backdrop for the upside and downside sensitivity cases. The Announced Pledges Scenario (APS) examines what would happen if all national energy and climate targets made by governments, including net zero goals, are met in full and on time. The Net Zero Emissions by 2050 (NZE) Scenario maps out an increasingly narrow path to reach net zero emissions by mid-century in a way that limits global warming to 1.5 °C.

Rising data centre electricity use, linked in part to growing use of AI, is already having some strong local impacts, but the potential implications of AI for energy are broader and include improved systems coordination in the power sector and shorter innovation cycles. There are more than 11 000 data centres registered worldwide and they are often spatially concentrated, so local effects on electricity markets can be substantial. However, at a global level, data centres account for a relatively small share of overall electricity demand growth to 2030.

STEPS, a scenario based on current policy settings, sees clean energy poised for huge growth, while coal, oil and natural gas each reach a peak by 2030 and then start to decline

Notes: EJ = exajoules; STEPS = Stated Policies Scenario; APS = Announced Pledges Scenario; NZE = Net Zero Emissions by 2050 Scenario. Oil, coal and natural gas refer to unabated uses as well as non-energy use. Clean energy includes renewables, modern bioenergy, nuclear, abated fossil fuels, low-emissions hydrogen and hydrogen-based fuels. Other includes traditional use of biomass and non-renewable waste.

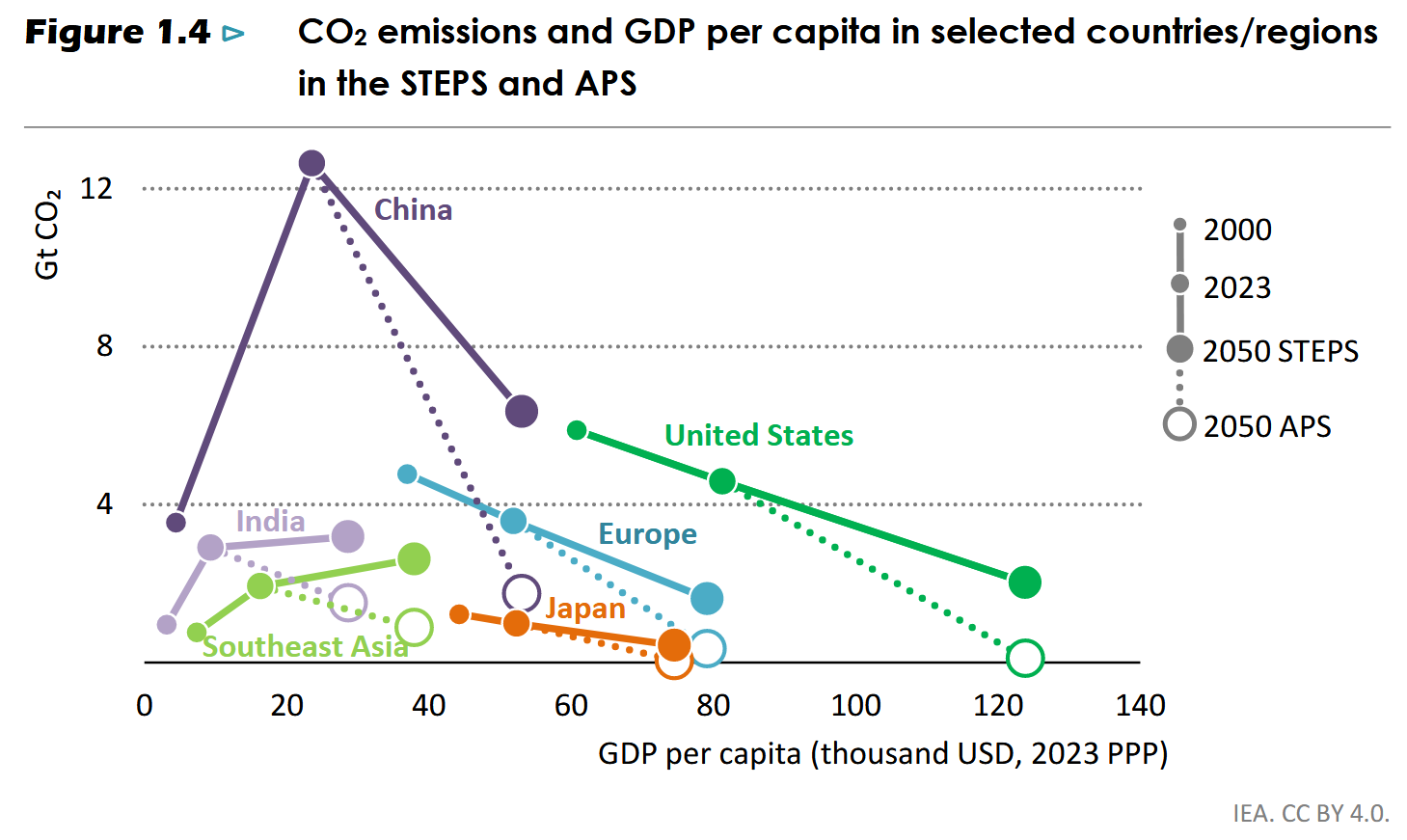

Global CO2 emissions peak and gradually decline to 2050, led by sharp drops in China as well as in advanced economies

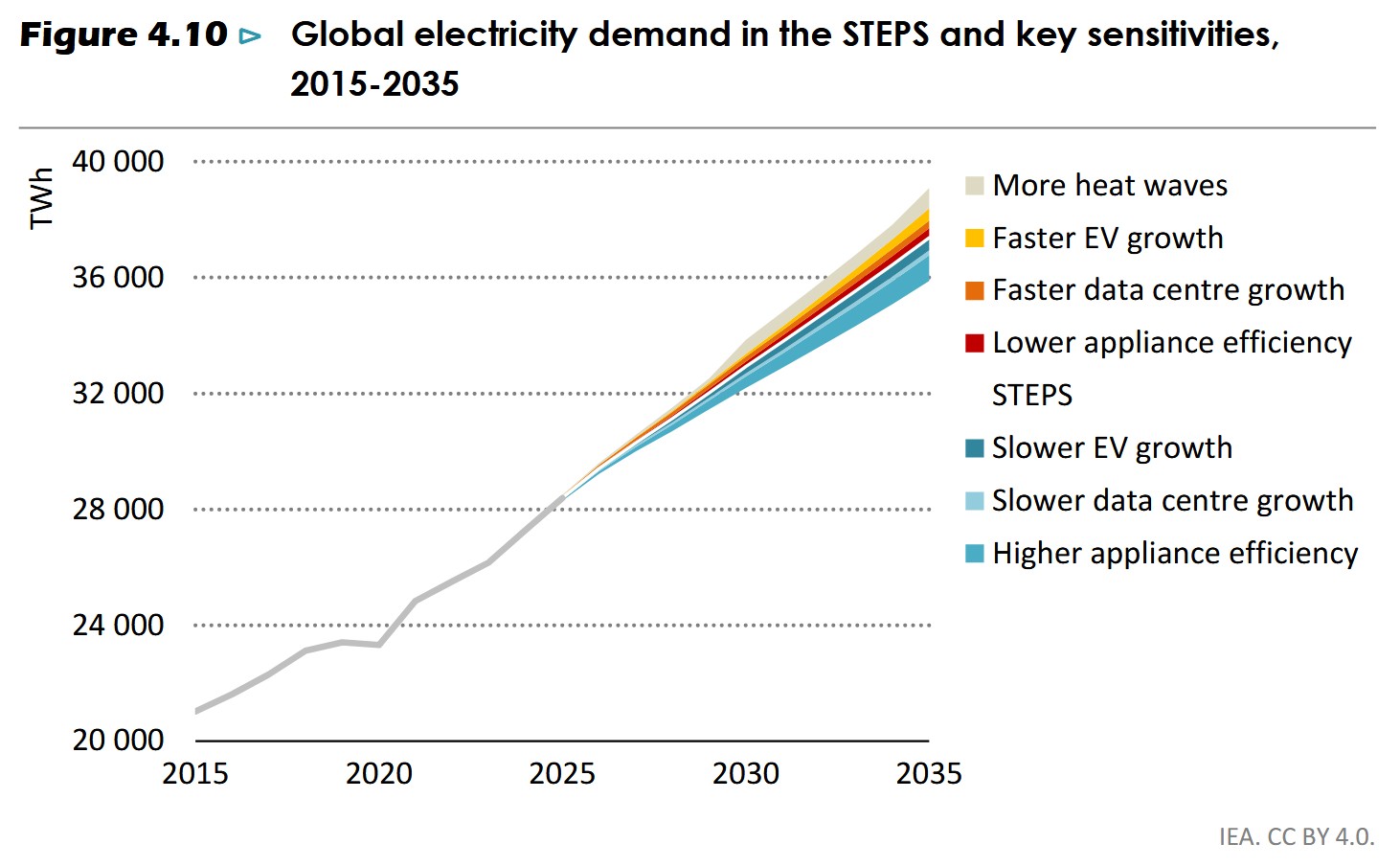

Electricity demand increases strongly in the STEPS, but several plausible uncertainties could push demand growth close to 15% above that of the STEPS level

In early 2024, over 11 000 data centres were registered worldwide. The number of servers installed increased around 4% per year between 2010 and 2020, but data centre electricity demand broadly plateaued as increasing information technology (IT) demands were mitigated by efficiency improvements in cooling and by workloads moving to larger and more efficient cloud data centres. In recent years, however, electricity consumption has picked up as efficiency improvements have been outpaced by surging demand for data centre services.

Data centre electricity consumption was estimated in 2022 to be in the range of 240 to 340 TWh, around 1% to 1.3% of total electricity consumption (excluding data networks and crypto mining). Although AI currently accounts for a relatively small share of global data centre electricity consumption, it is emerging as a new driver of growth.

The global venture capital sector has invested over USD 225 billion in AI startups over the past five years, compared to USD 143 billion over the same period in startups operating across all aspects of the clean energy sector. Driven in part by data centres and AI, capital spending by US technology giants Alphabet (Google), Meta (Facebook), Amazon and Microsoft reached around USD 150 billion in 2023, up by more than a factor of two on the 2019 level and equivalent to around 0.5% of US gross domestic product.

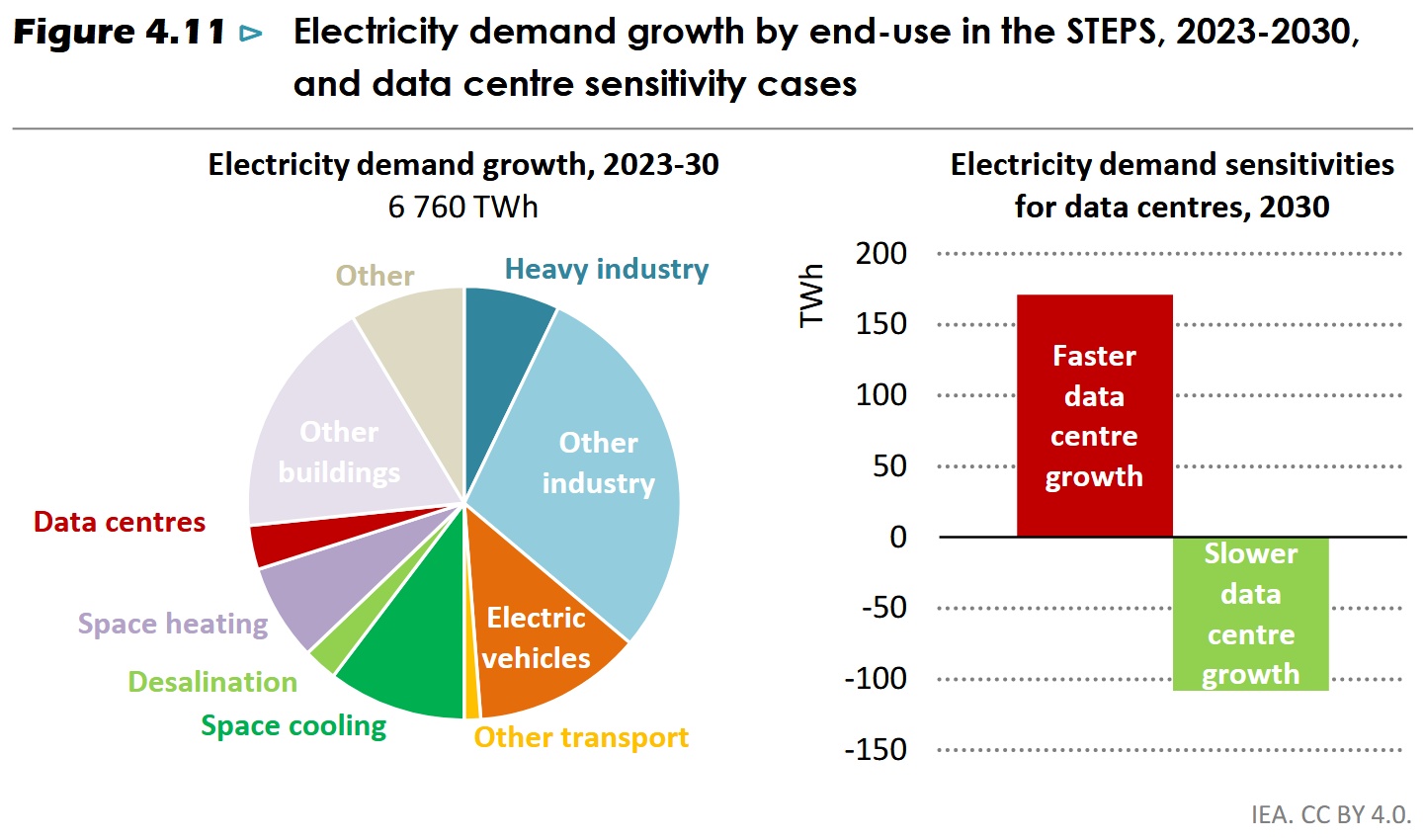

Data centres account for a small share of global electricity demand growth to 2030, and plausible high and low sensitivities do not change the outlook fundamentally

Data centre demand grows strongly but provides a relatively small contribution to overall electricity demand growth (Figure 4.11).

Driven by the rising demand for both AI and more conventional data centre services, global server capacity is expected to more than double by 2030. After a decade of substantial technical efficiency improvements and on the back of an increase in more energy-intensive data centre workloads, notably for AI, the rate of technical efficiency gains is expected to flatten (Masanet, 2020) (Uptime Institute, 2023). Consequently, global data centre electricity demand is anticipated to increase significantly by the end of this decade, with the scale dependent on technological advances in IT equipment and hardware deployment. In the base case, data centres account for less than 10% of total electricity demand growth at the global level, which is roughly on a par with demand growth for desalination, and less than a third of the demand growth for both EVs and space cooling in the buildings sector.

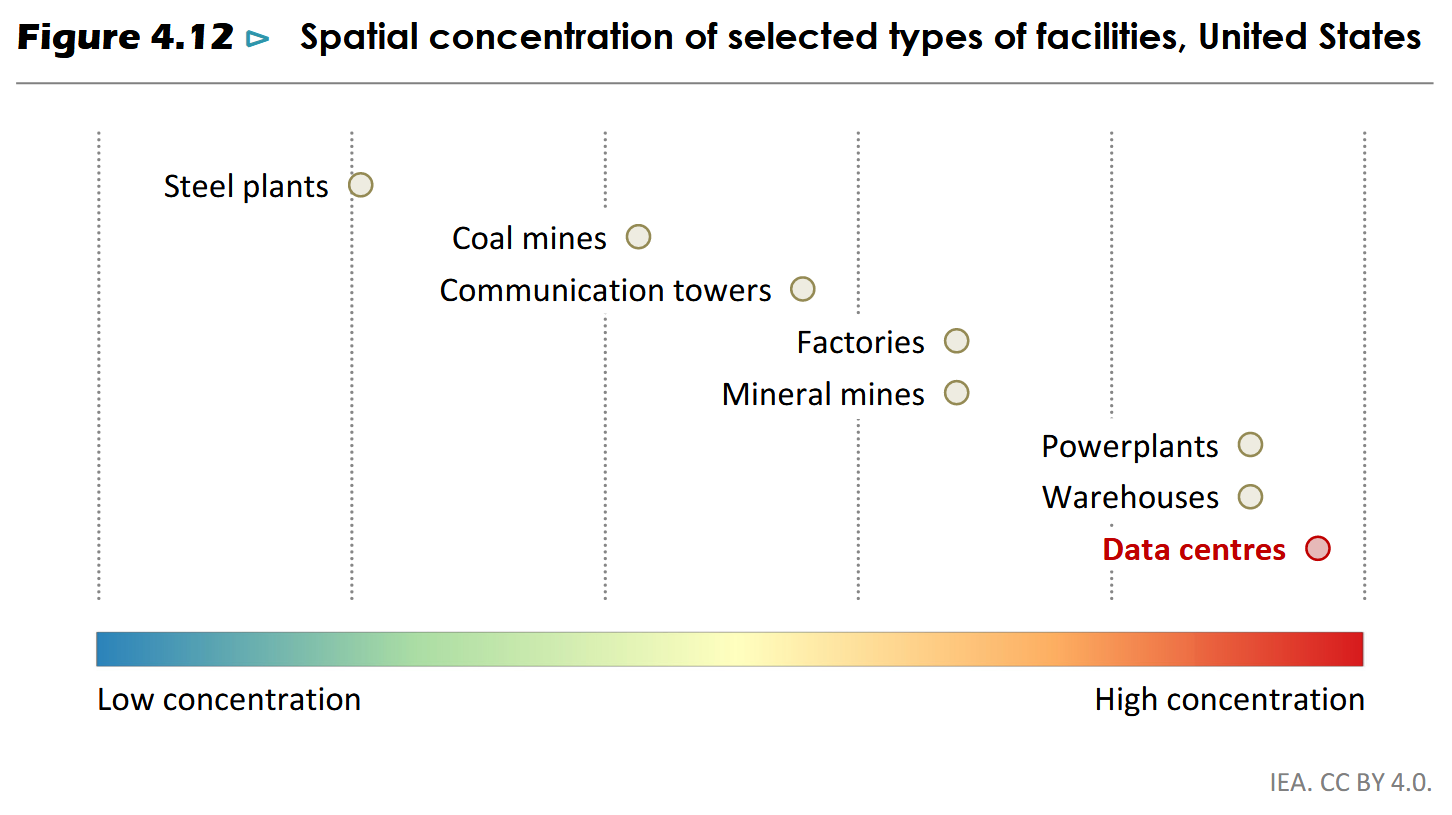

The top ten corporate buyers of clean energy power purchase agreements (PPAs) in 2023 included Amazon, Meta, Alphabet and Microsoft. Between 2023 and 2030, total data centre demand growth is projected to be just below 50% of the annual global increase in low-emissions sources of electricity over the last five years, so meeting this demand growth sustainably is feasible. However, data centres are very spatially concentrated, and constraints on generation and grid capacity may be more severe at the local level (Figure 4.12).

Overall, significant electricity demand increase from data centres is inevitable, but the extent of growth is uncertain. In any likely scenario, however, data centres look set to remain a relatively small driver of overall electricity demand growth at the global level in the decade to come. Nonetheless, constraints at the local level may be significant.

Data centres have an exceptionally high spatial concentration, which has significant implications for local power grids, given their substantial power requirements